Listen Now

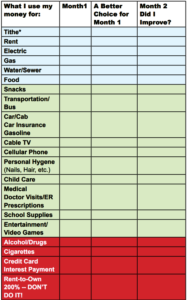

It’s pretty hard to find someone who doesn’t have to watch how they spend their money. The best way to plan how your money is spent is with a budget. Part one of budgeting is with the estimate. A Money Journal helps you figure out how the money that comes in (income) is spent. This can be very eye-opening because a little overspending in two or more categories can add up to a lot of overspending! Part two budgeting involves coming up with a plan based on what you’ve learned about your spending habits. You are able to decide where to make changes so there is enough money to buy what is needed. It also inspires you to find opportunities to earn extra money. A budget gives you power. It’s not about limits — it’s about informed decisions on where your money is spent.

Beginning the first of the month, save all your receipts. It’s important to keep a record of how much you spend FOR EVERYTHING. Using the receipts, list the amount you spent in the categories to the right. Write every total down, then add them for a grand total, which you can write into the Month 1 column for each category. Then look at each category, especially in the green and red sections, and ask yourself where you can cut back, change, or even eliminate any expense. The second month, follow the same procedure as Month 1. This time, ask yourself if you improved in your spending habits.

The expenses in blue are items that you have to pay. If utilities are paid in your rent, then leave it blank. (You still must have these things to live.)

The expenses in green are very much part of our lives. But It is possible to either cut down these costs, use less, or switch to something else in order to make your money go farther. And in some instances, you can choose to go without something for a time until it’s more affordable. Use the extra lines to add in more categories to show where your money goes.

MONEY SAVING TIP: Doing your taxes? Go to the IRS website to find out if you’re eligible for FREE help and where. (Criteria is based on income.)

The items in red are budget suckers. You don’t need them to live, and they do you no good. If you know of other budget suckers, write them down and promise yourself to get rid of them!

*Tithe is 10% of what you owe God. It’s that simple. It comes off the top of your income. God is always a rewarder and keeper of His own people who trust Him and obey. The truth is, you can’t afford not to tithe. You give your tithe at the church you attend.